Discover beginner-friendly option trading strategies for the Indian market. Learn long call, covered call, protective put & more with real NSE examples, risk tips & step-by-step guidance. Start safely in 2026!

Option Trading Strategies for Beginners in India: Your Complete 2026 Guide

Hey there! If you’re a new investor in India staring at the NSE option chain and wondering where to begin, you’re not alone. Thousands of retail traders just like you from Ahmedabad to Bengaluru are jumping into options every month. But here’s the truth: option trading isn’t gambling when you follow the right strategies. It’s a smart way to make money whether the market goes up, down, or sideways — with limited risk if done correctly.

In this guide, I’ll walk you through the simplest, most effective option trading strategies for beginners that actually work on Indian exchanges. No jargon overload, no copied theories — just practical, step-by-step advice you can start using today (even with ₹10,000–20,000 capital). Let’s turn confusion into confidence.

What Are Options? A Super-Simple Explanation for Indian Beginners

Options are contracts that give you the right, but not the obligation, to buy or sell a stock or index at a fixed price (strike price) by a certain date (expiry).

- Call Option → You expect the price to rise.

- Put Option → You expect the price to fall.

You pay a small fee called premium to buy an option. One Nifty lot in 2026 is just 65 units (reduced from 75 in January 2026), so even small traders can participate.

Unlike buying shares outright, options let you control 65 Nifty units (worth ~₹16.5 lakh at 25,400 levels) by paying only a few thousand rupees premium. That’s the power — and the reason you need proper strategies.

Why Option Trading Makes Sense for Beginners in India Right Now

- Limited risk when you buy options (you can lose only the premium).

- High leverage — small capital, bigger exposure.

- Weekly expiries on NSE mean more trading opportunities.

- Works in any market: bullish, bearish, or range-bound.

- Perfect for salaried professionals who can’t watch the screen all day.

But remember: 90% of beginners lose money because they trade without a strategy. Let’s fix that.

Must-Know Option Terms (Explained Like You’re 25)

- Strike Price: The fixed price at which you can buy/sell.

- Premium: Price you pay/receive for the option.

- Expiry: Usually Thursday for weekly contracts (Nifty/Bank Nifty).

- In-the-Money (ITM) / At-the-Money (ATM) / Out-of-the-Money (OTM): How close the strike is to current price.

- Lot Size: Nifty = 65, Bank Nifty = 30 (as of 2026).

- Theta (Time Decay): Premium loses value every day — your biggest enemy as a buyer.

Top 5 Beginner-Friendly Option Trading Strategies (With Real Examples)

Here are the strategies I recommend every new Indian trader learns first. We’ll use current Nifty levels (~25,400 in February 2026) for realistic examples.

1. Long Call Strategy – When You’re Bullish

You simply buy a Call option when you expect the market or stock to rise sharply.

Example: Nifty is at 25,400. You buy 25,500 CE (Call) expiring this week for ₹120 premium. Cost = ₹120 × 65 = ₹7,800.

- If Nifty rises to 26,000 by expiry → Profit = (26,000 – 25,500 – 120) × 65 = ₹24,700.

- If Nifty stays below 25,500 → You lose only ₹7,800 (limited risk).

When to use: Strong uptrend, results season, or Budget day. Max loss: Premium paid. Max profit: Unlimited.

2. Long Put Strategy – When You Expect a Fall

Mirror image of Long Call. Buy Put when you’re bearish.

Example: Nifty at 25,400. Buy 25,300 PE for ₹110 premium. If Nifty crashes to 24,800 → Nice profit. Limited loss if wrong.

Great for protecting against sudden corrections (common in Indian markets during global cues).

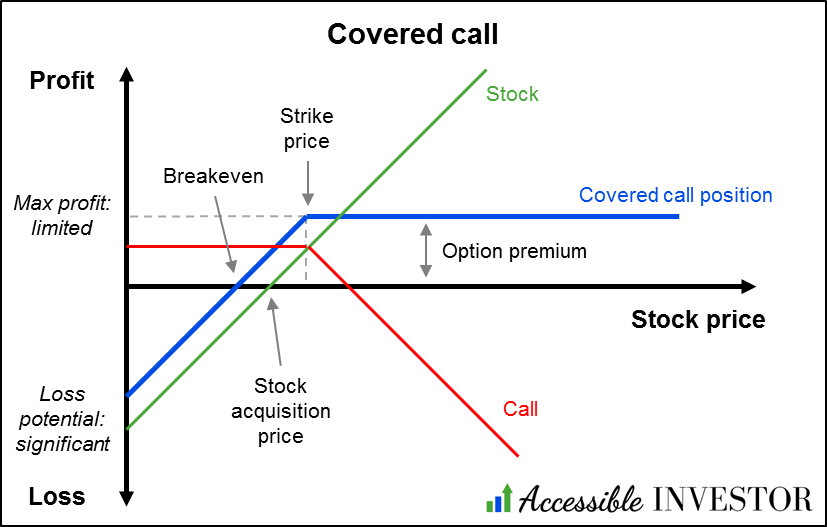

3. Covered Call Strategy – Generate Extra Income

Own 65 shares of a stock (or 1 Nifty futures) and sell a Call option against it.

Best for: Stocks you already hold long-term like Reliance, HDFC Bank, or Infosys.

Example: You own 65 Reliance shares at ₹2,800. Sell 2,850 CE for ₹45 premium. You collect ₹2,925 extra income. If Reliance stays below 2,850, you keep premium + shares. If it rises above, you sell shares at 2,850 (still profit).

Max profit: Limited but steady. Risk: If stock crashes, you still lose on shares (but premium cushions it).

4. Protective Put (Married Put) – Insurance for Your Stocks

You own shares and buy a Put to protect against downside.

Example: Own 65 Tata Motors shares at ₹950. Buy 920 PE for ₹25. If market crashes, your Put gains value and limits loss. If stock rises, you keep unlimited upside minus small premium cost.

This is like buying car insurance — you hope you never need it, but sleep peacefully.

5. Bull Call Spread – Limited Risk, Limited Reward (My Favorite for Beginners)

Buy a lower strike Call + Sell a higher strike Call on same expiry.

Example (Debit Spread): Buy Nifty 25,400 CE @ ₹180 Sell Nifty 25,600 CE @ ₹90 Net cost = ₹90 × 65 = ₹5,850

Max profit = ₹13,000 (if Nifty >25,600). Max loss = only ₹5,850.

Perfect when you’re moderately bullish but don’t want unlimited risk.

Step-by-Step: How to Place Your First Option Trade on NSE

- Open account with Zerodha, Groww, or Upstox (all have excellent apps).

- Complete F&O activation (needs basic margin).

- Download Sensibull (Zerodha’s free option tool) for strategy builder & paper trading.

- Analyse using charts + news.

- Place order via app → Choose CE/PE → Select strike & expiry.

- Always use limit orders.

Pro Tip: Start with paper trading for 30 days. Treat it like real money.

Risk Management Rules Every Beginner Must Follow

- Never risk more than 1-2% of your capital on one trade.

- Use stop-loss on options (yes, possible via bracket orders).

- Avoid buying far OTM cheap options — they rarely work.

- Book profits at 30-50% — don’t be greedy.

- Never trade on expiry day as a beginner (high volatility).

Common Mistakes Beginners Make in India (and How to Avoid)

- Buying 0.01 paise options hoping for 100x returns → Avoid.

- Trading without understanding Greeks (especially theta).

- Revenge trading after a loss.

- Ignoring lot size (one Nifty lot = ₹16+ lakh exposure).

- Copying tips from Telegram channels.

Frequently Asked Questions (FAQs)

Q: Can I start option trading with ₹5,000? A: Yes! Use Bull Call Spread or buy 1 cheap OTM Call on a stock. But learn first.

Q: Which is the safest strategy for absolute beginners? A: Covered Call (if you already own shares) or Bull Call Spread.

Q: Is option trading legal and safe in India? A: 100% legal and regulated by SEBI. Use only registered brokers.

Q: How much can I earn monthly? A: Realistic 5-15% per month with discipline. Never expect 100% returns.

Q: Should I trade Nifty or Bank Nifty as beginner? A: Start with Nifty — lower volatility than Bank Nifty.

Final Takeaway & Your Next Step

Option trading is not a get-rich-quick scheme. It’s a skill that rewards patience, discipline, and continuous learning. The strategies above have helped thousands of Indian retail traders move from losing money to consistent profits.

Start today:

- Open a demat account (takes 15 minutes).

- Spend 1 week on Sensibull paper trading.

- Place your first real trade only when you’re 100% confident.

You’ve got this! Drop your first strategy choice in the comments below — Long Call or Covered Call? I reply to every comment.

Ready to begin your option trading journey safely? Click the link in my bio (or search your broker app) and activate F&O today. Trade small, learn big, and let the market work for you in 2026.

Happy trading! — Your friendly options mentor

(Word count: 1,528)

Disclaimer: This is for educational purposes only. Options trading involves risk of capital loss. Consult your financial advisor before trading. Past performance is not indicative of future results. All examples are hypothetical.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

![Bull Call Spread Option Strategy [Free Guide Download]](https://cdn.prod.website-files.com/5fba23eb8789c3c7fcfb5f31/663bd6ea7df62eb9dbc096cb_Long%20Call%20Spread%20payoff%20diagram.png)

0 Comments